A digital asset treasury holds cryptocurrency as a core reserve asset rather than cash or traditional securities. Michael Saylor pioneered this approach by turning Strategy, the data analytics company he co-founded in 1989, into what is essentially a Bitcoin DAT. This established a playbook that's now being adapted across other digital assets, including Solana. including Solana.

The underlying thesis is fairly straightforward. If you believe a digital asset will appreciate and generate productive yield, holding it as a treasury asset can create more value than depreciating cash reserves.

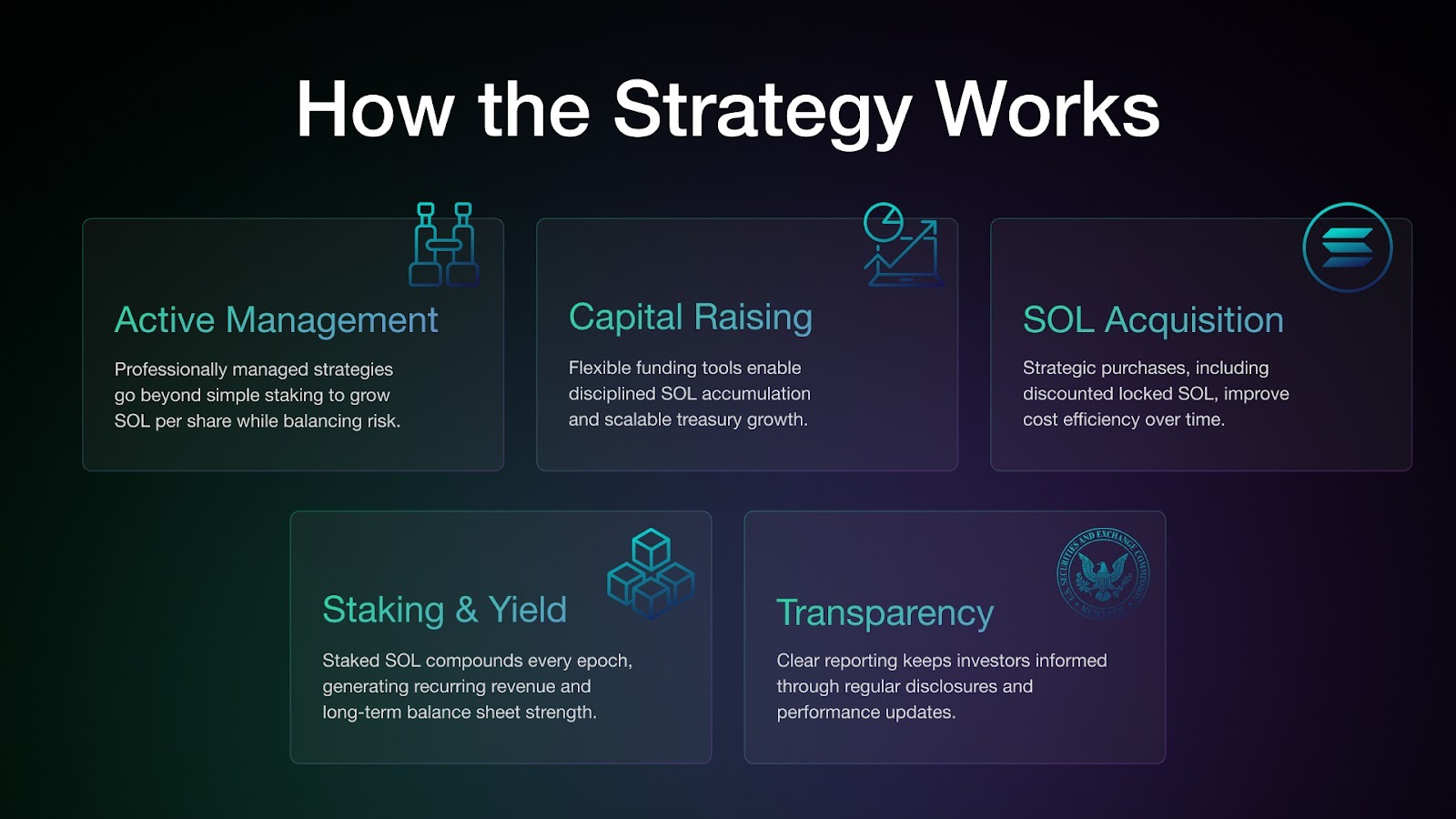

A Solana treasury company is a publicly traded entity that holds SOL as its primary asset. The typical playbook involves raising capital through equity offerings, convertible notes, or private placements in public equity (PIPEs). Those proceeds are then deployed to acquire SOL.

Once acquired, many companies stake their SOL through professional validators, with some operating their own validator infrastructure. SOL Strategies, for instance, has 2.8 million SOL delegated to their validators from both treasury holdings and third-party delegations as of November 2025. The north star metric for these operations is “SOL per share”—the Solana equivalent of Strategy's “BTC per share” metric.

The key differentiator for Solana treasuries is yield generation, as Bitcoin holdings don't produce cash flow. However, because Solana uses a combination of Proof of Stake (PoS) and Proof of History (PoH) to secure the blockchain, SOL tokens can be staked to help validate the network. This currently earns holders about 5.5% to 7.5% annual yields paid in additional SOL tokens, representing real, on-chain revenue generation.

Solana treasury management companies follow a progression that turns emerging asset holders into institutional digital asset managers. The core steps typically include:

Solana DATs are perhaps among the most asymmetric ways to gain exposure to the network’s growth, allowing holders to potentially benefit from compounding returns tied to the potential growth and adoption of the Solana ecosystem itself.

The value proposition extends beyond simply buying SOL directly. They include:

Treasury companies generate passive income through staking. While traditional U.S. government bonds currently yield 4–5%, Solana staking currently produces about 6–7% annual percentage yield (APY), and that’s before factoring in any change in SOL’s market price. This yield derives from network inflation, currently 4.2%, plus real economic activity through transaction fees and maximal extractable value (MEV), which together contribute an additional 1–2%.

Solana's inflation rate began at 8% year-over-year (YoY) but declines by 15% annually. It will eventually reach a long-term fixed inflation rate of 1.5%, assuming no major changes are made to the protocol.

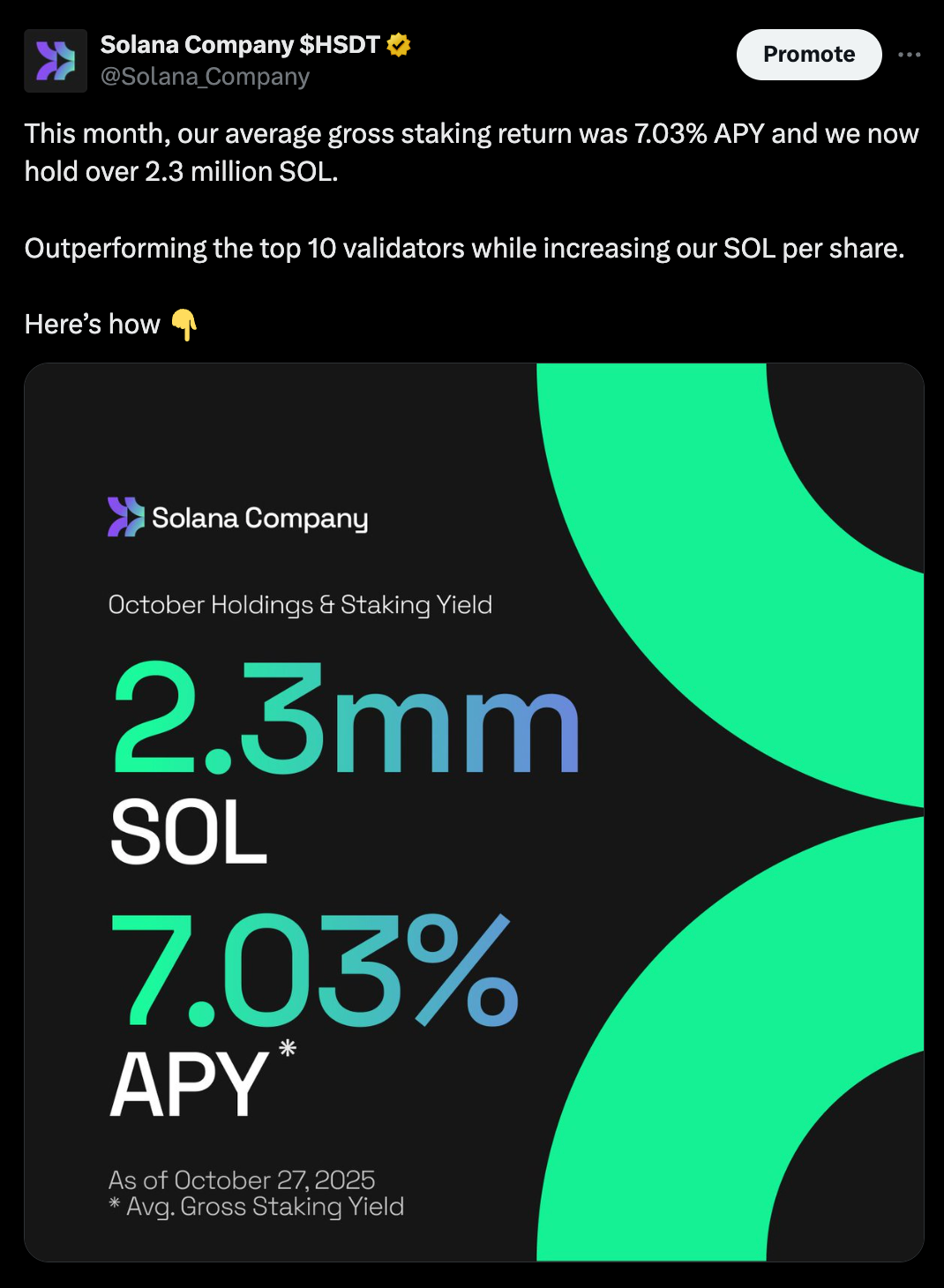

Professional management can make a measurable difference. Solana Company reported October 2025 staking yields of over 7% APY, outperforming the top 10 validator averages by 36 basis points. That performance reflects the value of institutional-grade validator selection and disciplined treasury management.That performance reflects the value of institutional-grade validator selection and disciplined treasury management.

Solana has matured into production-grade infrastructure. The network processes thousands of transactions per second while maintaining millions of daily active wallets. Growth spans DeFi, payments, gaming, and real-world asset tokenization, with notable partnerships including integration with BlackRock's BUIDL fund and plans to deploy the EUR CoinVertible (EURCV) stablecoin on Solana with Societe Generale Forge.

From an incremental growth perspective, Solana has captured the lion's share of new application development and new developers over the past two years. Treasury companies provide levered exposure to this expansion—as adoption increases, transaction fees grow, MEV opportunities expand, and fundamental value accruing to stakers compounds.

Managing individual SOL staking involves wallet security, validator selection, uptime monitoring, and epoch timing. And while Solana does not currently implement slashing, there is a roadmap to introduce it. While manageable, investing in Solana requires ongoing attention and technical understanding that many investors prefer to outsource.

Treasury companies can provide institutional infrastructure, including custody solutions, diversified staking, and 24/7 monitoring systems. At scale, these operational advantages are difficult for individual investors to replicate. Running your own validator on Solana requires meaningful stake to be economically viable, but it can generate better yields for those who can execute effectively.

Solana treasury companies are democratizing institutional-grade infrastructure, allowing investors to participate in the sophisticated decentralized Solana network accessible to anyone looking to participate in the Solana’s growth.

From a positioning perspective, Solana currently represents approximately 5% of Bitcoin's market cap. While Bitcoin has grown to multi-trillion-dollar scale, SOL maintains significant headroom for appreciation as it continues capturing market share from other Layer 1 blockchains.

When Multicoin Capital led the Forward Industries investment, its investment thesis helped highlight Solana’s potential: real yield generation, economic sustainability, and compelling valuation metrics.

While we believe the opportunity is substantial, several risk factors warrant careful evaluation before allocating capital to Solana treasury stocks or related assets.

We think that investors should weigh these challenges not as deal-breakers, but as parameters that define the maturity and sustainability of this still emerging asset class. Regulatory clarity, validator stability, and market resilience will determine whether Solana treasuries evolve into a recognized institutional asset or remain a niche, high-beta proxy for SOL itself.

The regulatory framework for digital asset treasuries continues to develop. While Treasury and IRS guidance have clarified certain tax reporting requirements for brokers, questions remain regarding securities law application, accounting treatment for mark-to-market volatility, and corporate governance standards.

Progress is evident: The Financial Accounting Standards Board’s Accounting Standards Update (ASU) 2023-08 now requires fair-value measurement for crypto holdings, representing substantial improvement over prior guidance. At a policy level, recent executive actions from Washington have signaled a more innovation-oriented stance toward digital assets. Nevertheless, regulatory uncertainty remains a material risk factor that could impact operations and valuation.

While Solana's consensus mechanism doesn't implement aggressive slashing like Ethereum, risks do exist. Validator downtime results in missed rewards. Security breaches or misconfigurations could expose staked assets to penalties, and operating validator infrastructure requires continuous DevOps expertise, monitoring, and security protocols.

Treasury companies mitigate these exposures through professional validators and stake diversification, but they cannot eliminate risk entirely. Operational infrastructure costs—enterprise-grade servers, monitoring systems, and specialized personnel—are also an ongoing expense that impacts shareholder yield.

SOL’s price volatility directly impacts treasury company valuations. DATs or exchange-traded funds (ETFs) such as SOLT represent exposure to SOL price movements, so their valuations typically move in lockstep with SOL itself, especially if leveraged, which amplifies gains during rallies and losses during downturns.

Unlike a more traditional public company, which might have multiple revenue streams from different parts of its business, treasury company valuations move primarily with their holdings. The relatively high staking yield provides a modest downside cushion but cannot offset some of the larger price declines. We believe this concentrated risk profile may suit investors who accept crypto volatility for potential upside, but it may not be the right fit for those seeking a more conservative investment strategy.

Shares of Solana treasury companies can often be purchased through standard brokerage accounts, eliminating custody concerns and seed phrase security issues.

Due diligence should precede any investment. Platforms like CoinGecko maintain real-time data on Solana treasury holdings, making it easy to track reserves independently. Since these are public companies, they also file reports with the SEC that you can review, and assessing management’s expertise is much easier than with a privately held firm.

Solana Company (NASDAQ: HSDT) operates as a publicly traded vehicle for Solana exposure. Instead of setting up wallets and managing private keys, investors can simply buy its shares through any standard brokerage account. The more technical aspects of investing in digital assets are handled on the investor’s behalf, while shareholders could benefit from Solana’s growth through a regulated, familiar structure.

Solana treasury companies stake SOL through reliable validators to avoid single points of failure. Custody partners ideally secure the assets in digital vaults, and rewards accrue from network inflation and fees every few days. With the right management and institutional infrastructure, it is our opinion it can be a safer and smoother way to earn yield.

Volatility hits valuations directly, and changing regulations could alter how these companies operate. Validator downtime, poor management, or thin liquidity can also hurt returns. Because performance depends on Solana’s overall health, investors should assess technical, regulatory, and execution among other risks, before committing.This is not an exhaustive list of all of the risks in investing in a Solana-based treasury.

Clarity, diversification, and long-term growth. That means transparent acquisition strategies, staking across multiple validators, and institutional-grade custody. Leading firms like Solana Company issue regular benchmarked reports and focus on SOL per share growth over short-term gains. Strong governance and active ecosystem engagement are key.

Review SEC filings and investor updates, then cross-check holdings using blockchain analytics tools like Solscan. Assess the board’s makeup, voting rights, and management incentives. Validator performance can also be verified through Solana Explorer.

This blog is for informational purposes only and does not contain all information pertinent to an investment decision. Nothing in this blog constitutes an investment recommendation or an offer of investment advisory services. This blog cannot be relied upon in making an investment decision. Nothing contained herein constitutes an offer to sell, or a solicitation to buy, any securities. This blog contains information Pantera believes to be reliable, and has been obtained from sources believed to be reliable, but Pantera makes no representation or warranty (express or implied) of any nature, nor accepts any responsibility or liability of any kind, with respect to the fairness, accuracy, completeness, or reasonableness of the information or opinions contained herein. Analyses and opinions contained herein (including market commentary, statements or forecasts) reflect the judgment of Pantera as of the date this blog was published, and may contain elements of subjectivity (including certain assumptions) or be based on incomplete information.

Sources:

Staking yield for Solana Company - https://www.nasdaq.com/press-release/solana-company-announces-updated-sol-holdings-and-industry-leading-staking-yield-2025

Solana holdings - https://blockworks.com/analytics/treasury-companies/solana-treasury-companies/solana-treasury-companies-sol-holdings-by-company/

Strategy founding date - https://www.strategy.com/investor-relations/executive-team/michael-saylor

SOL Strategies - https://solstrategies.io/press-releases/sol-strategies-october-monthly-business-update

Solana uses POS and POH to secure the blockchain - https://solana.com/developers/evm-to-svm/consensus

Solana staking yields - https://www.bitget.com/academy/solana-staking-guide-2025

Locking SOL discounts - https://www.helius.dev/blog/solana-digital-asset-treasury-companies

Institutional interest in Solana - https://www.bitget.com/news/detail/12560605037333

Solana epoch status - https://parafi.tech/solana/epoch-status

US bonds yield - https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2025

Solana current inflation rate - https://solanacompass.com/tokenomics

Solana initial inflation rate - https://solana.com/pl/staking

Transaction processing speed - https://explorer.solana.com/

Active addresses on Solana - https://www.theblock.co/data/on-chain-metrics/solana/number-of-active-addresses-on-the-solana-network-daily-7dma

BUIDL expansion to Solana - https://www.theblock.co/post/348048/solana-becomes-7th-blockchain-onboard-blackrocks-yield-bearing-money-market

Societe Generale Forge integration - https://www.sgforge.com/societe-generale-forge-solana-network/

New application development and developers - https://www.sgforge.com/societe-generale-forge-solana-network/

Solana slashing roadmap - https://docs.anza.xyz/proposals/optimistic-confirmation-and-slashing#slashing-roadmap

Running your own validator on Solana requirements - https://wublock.substack.com/p/solanas-staking-volume-surpasses

Solana market cap - https://coinmarketcap.com/currencies/solana/

Bitcoin market cap - https://coinmarketcap.com/currencies/bitcoin/

Forward Industries investment - https://multicoin.capital/2025/09/11/creating-the-worlds-leading-solana-treasury-company/

Treasury and IRS guidance - https://home.treasury.gov/news/press-releases/jy2438

The Financial Accounting Standards Board’s Accounting Standards Update (ASU) 2023-08 - https://dart.deloitte.com/USDART/home/publications/deloitte/heads-up/2023/fasb-issues-asu-crypto-assets

SOLT - https://www.volatilityshares.com/solt

Solana treasury holdings - https://www.coingecko.com/en/treasuries/solana